We all know that the Indian Telecom sector is at the cusp of a major reshuffle in the coming months/quarters as RelJio is slated to start offering it's 4G services very soon. So I thought it fit to do a status check of market shares of all the existing Telecom operators in the country. And while doing this data collation & analysis, I did find many interesting findings.

We have a total of 12 active telecom operators in the country with the 13th one to start operations very soon. Out of the existing 12, 5 operators are regional ones with operations in less than 7 circles each. I have collated data on the Quarterly Adjusted Gross Revenues (AGR) and Quarter-ending Wireless Subscribers market shares of all the operators. Please do note that the AGR includes both Wireless & Wireline operations of operators active in both segments.

BSNL&MTNL, Bharti Airtel, Reliance Communications and Tata Teleservices have some notable Wireline operations in various circles across the country. Amongst these BSNL&MTNL are the biggest ones controlling around 75 to 78% marketshare, but they have been losing it with every passing month bit-by-bit. Bharti Airtel is the next largest with about 13-14% market share, followed by Tata Teleservices with about 6% and most of the rest with Reliance Communications. Please do remember that the subscriber numbers in the Wireline segment are less than 3% of the Wireless subscriber base across the country. But at the same time, the ARPU (Average Revenue Per User) from the Wireline segment is 3 to 4 times that of the Wireless segment, atleast in case of the Private sector operators.

Coming to Wireless Subscribers market shares, the Top-3 operators, (i.e. Airtel, Vodafone & Idea) have strengthened their position with their combined market share improving from 56.1% to 59.2% (310 bps improvement) over the last 6 quarters. Amongst them, Idea Cellular alone has improved it's share by 170 bps. Apart from the Top-3, the operators that have managed an improvement in subscribers market share over last 6 quarters are: Aircel (67 bps), Telenor (85 bps), Videocon (24 bps) and Quadrant (6 bps). Amongst the market share losers, the 3 biggest losers are: BSNL (246 bps), Reliance Comm. (118 bps) and Tata Tele (75 bps).

After losing subscribers market share quarter-after-quarter and also losing it's No.5 position to Aircel, BSNL has finally managed to stop this trend with a minor market share improvement in Sept'15 quarter. As per various media reports, BSNL is said to be back in the game & is looking to ensure it's operational improvement in the coming quarters. BSNL's resurgence and RelJio's entry are 2 big things to worry for all the operators, including the Top-3 trio of Airtel, Vodafone & Idea.

Now let's discuss the AGR market shares as there are quite a few interesting findings here. Here the Top-3 operators have an even stronger hold with almost 70% market share. Airtel has a huge lead with a 30.1% market share and 850 bps lead over the No.2 operator Vodafone. Not just that, Airtel's AGR market share is 650 bps higher than it's own Subscribers market share. In fact, each of the Top-3 operators have an AGR market share higher than their respective Subscribers market shares. Vodafone's AGR share is about 270 bps higher, while Idea's share is about 140 bps higher than it's Subscribers share. This statistic clearly suggests that the quality of subscribers of the Top-3 operators is very good and each of them must be enjoying near Industry-best ARPUs in most of their circles of strength.

The weakest amongst the larger operators is definitely Reliance Communications. It's Subscribers share is a respectable figure of 11.1%, making it the No.4 operator, but it's AGR share is a lowly 4.3%, making it the No.7 operator here. This fact clearly reflects the quality of RCom's subscriber base. RCom certainly must be having the lowest ARPUs in the industry and that too by a huge margin. An AGR share of 680 bps lower than it's own Subscribers share is too massive to ignore. I sometimes do wonder, how did RCom manage this feat even after being in this business for so long. All this despite the fact that RCom has 3G license for the 2 prime Metro circles of Mumbai & Delhi and also has nearly 12 lakh Wireline subscribers, just about 30% less than Tata Tele's Wireline number. Something must be terribly wrong with RCom network & quality of service, which has brought it to this situation.

Other than RCom, operators who have an AGR share lower than their respective Subscribers share are: Aircel (320 bps), Telenor (260 bps) and Videocon (70 bps).

Now coming to those operators who have an AGR share higher than their respective Subscribers share are: BSNL (120 bps), MTNL (120 bps) and Tata Tele (50 bps). The thing that is common between these 3 operators is their healthy Wireline business. BSNL&MTNL together have over 20 million Wireline subscribers, but majority of them must be Residential users still and spread out across several cities. On the other hand, the private sector operators have Wireline business only in a handful of cities and cater mainly to Corporate & SME clients or large Housing complexes. Tata Tele's Wireline subscriber base of about 1.7 million is less than 3% of it's Total Subscribers base, but it's contribution to it's AGR must be easily in the range of 8 to 10%.

On a Trailing-Twelve-Months basis, the Indian Telecom Industry's Total AGR has posted a growth of about 3% Q-o-Q in the recent quarters. Airtel & Vodafone are also growing at a similar pace of between 3% to 3.5% Q-o-Q. Idea Cellular has managed to grow a little faster at rates between 5% to 6% and hence has seen the biggest improvement in Quarterly AGR market share of 210 bps over the last 6 quarters. BSNL's AGR numbers are clearly suggesting the start of it's turnaround. BSNL Quarterly AGR share had fallen from 10.6% in March'14 to a low of 8% in Dec'14, but has smartly bounced back to 9.2% in Sept'15 quarter. And there is also the possibility of operational consolidation between BSNL & MTNL, which could give further impetus to BSNL's resurgence.

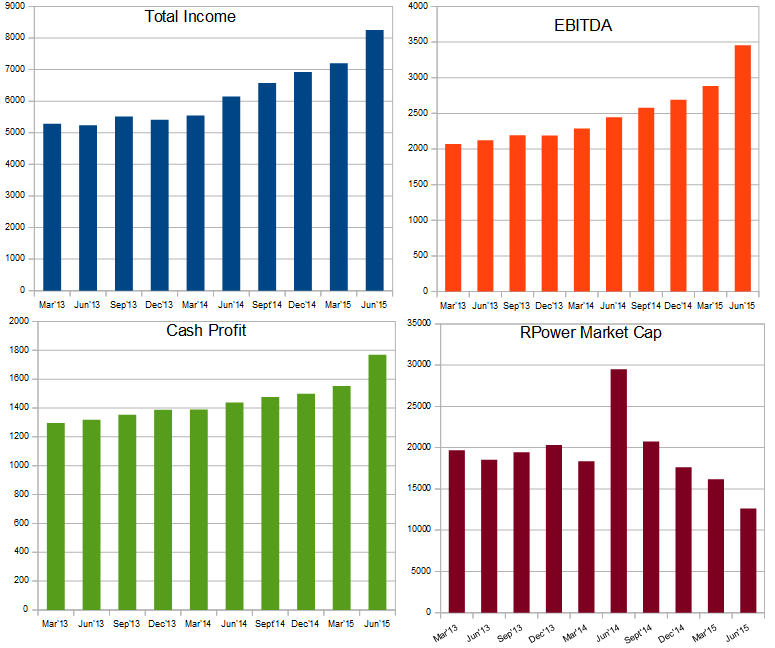

RCom again is probably the only major operator who has seen it's T-T-M AGR fall consistently over the recent quarters, from Rs.7885 crores in Dec'14 to Rs.7188 crores in Sept'15. RCom's quarterly AGR share is down from 6.4% in Mar'14 to just 4.3% in Sept'15. And things could worsen further in Dec'15 quarter as RCom is slated to shut down it's 2G operations in a few circles due to license expiry. RCom is solely riding on 2 hopes: first it's consolidation with Sistema, which will add to it's 800/850 MHz spectrum holding and then sharing/trading this spectrum holding with RelJio and ride on the latter's 4G network. The slight chance of consolidating with RelJio is what is keeping RCom alive.

We have a total of 12 active telecom operators in the country with the 13th one to start operations very soon. Out of the existing 12, 5 operators are regional ones with operations in less than 7 circles each. I have collated data on the Quarterly Adjusted Gross Revenues (AGR) and Quarter-ending Wireless Subscribers market shares of all the operators. Please do note that the AGR includes both Wireless & Wireline operations of operators active in both segments.

BSNL&MTNL, Bharti Airtel, Reliance Communications and Tata Teleservices have some notable Wireline operations in various circles across the country. Amongst these BSNL&MTNL are the biggest ones controlling around 75 to 78% marketshare, but they have been losing it with every passing month bit-by-bit. Bharti Airtel is the next largest with about 13-14% market share, followed by Tata Teleservices with about 6% and most of the rest with Reliance Communications. Please do remember that the subscriber numbers in the Wireline segment are less than 3% of the Wireless subscriber base across the country. But at the same time, the ARPU (Average Revenue Per User) from the Wireline segment is 3 to 4 times that of the Wireless segment, atleast in case of the Private sector operators.

After losing subscribers market share quarter-after-quarter and also losing it's No.5 position to Aircel, BSNL has finally managed to stop this trend with a minor market share improvement in Sept'15 quarter. As per various media reports, BSNL is said to be back in the game & is looking to ensure it's operational improvement in the coming quarters. BSNL's resurgence and RelJio's entry are 2 big things to worry for all the operators, including the Top-3 trio of Airtel, Vodafone & Idea.

Now let's discuss the AGR market shares as there are quite a few interesting findings here. Here the Top-3 operators have an even stronger hold with almost 70% market share. Airtel has a huge lead with a 30.1% market share and 850 bps lead over the No.2 operator Vodafone. Not just that, Airtel's AGR market share is 650 bps higher than it's own Subscribers market share. In fact, each of the Top-3 operators have an AGR market share higher than their respective Subscribers market shares. Vodafone's AGR share is about 270 bps higher, while Idea's share is about 140 bps higher than it's Subscribers share. This statistic clearly suggests that the quality of subscribers of the Top-3 operators is very good and each of them must be enjoying near Industry-best ARPUs in most of their circles of strength.

The weakest amongst the larger operators is definitely Reliance Communications. It's Subscribers share is a respectable figure of 11.1%, making it the No.4 operator, but it's AGR share is a lowly 4.3%, making it the No.7 operator here. This fact clearly reflects the quality of RCom's subscriber base. RCom certainly must be having the lowest ARPUs in the industry and that too by a huge margin. An AGR share of 680 bps lower than it's own Subscribers share is too massive to ignore. I sometimes do wonder, how did RCom manage this feat even after being in this business for so long. All this despite the fact that RCom has 3G license for the 2 prime Metro circles of Mumbai & Delhi and also has nearly 12 lakh Wireline subscribers, just about 30% less than Tata Tele's Wireline number. Something must be terribly wrong with RCom network & quality of service, which has brought it to this situation.

Other than RCom, operators who have an AGR share lower than their respective Subscribers share are: Aircel (320 bps), Telenor (260 bps) and Videocon (70 bps).

Now coming to those operators who have an AGR share higher than their respective Subscribers share are: BSNL (120 bps), MTNL (120 bps) and Tata Tele (50 bps). The thing that is common between these 3 operators is their healthy Wireline business. BSNL&MTNL together have over 20 million Wireline subscribers, but majority of them must be Residential users still and spread out across several cities. On the other hand, the private sector operators have Wireline business only in a handful of cities and cater mainly to Corporate & SME clients or large Housing complexes. Tata Tele's Wireline subscriber base of about 1.7 million is less than 3% of it's Total Subscribers base, but it's contribution to it's AGR must be easily in the range of 8 to 10%.

On a Trailing-Twelve-Months basis, the Indian Telecom Industry's Total AGR has posted a growth of about 3% Q-o-Q in the recent quarters. Airtel & Vodafone are also growing at a similar pace of between 3% to 3.5% Q-o-Q. Idea Cellular has managed to grow a little faster at rates between 5% to 6% and hence has seen the biggest improvement in Quarterly AGR market share of 210 bps over the last 6 quarters. BSNL's AGR numbers are clearly suggesting the start of it's turnaround. BSNL Quarterly AGR share had fallen from 10.6% in March'14 to a low of 8% in Dec'14, but has smartly bounced back to 9.2% in Sept'15 quarter. And there is also the possibility of operational consolidation between BSNL & MTNL, which could give further impetus to BSNL's resurgence.

RCom again is probably the only major operator who has seen it's T-T-M AGR fall consistently over the recent quarters, from Rs.7885 crores in Dec'14 to Rs.7188 crores in Sept'15. RCom's quarterly AGR share is down from 6.4% in Mar'14 to just 4.3% in Sept'15. And things could worsen further in Dec'15 quarter as RCom is slated to shut down it's 2G operations in a few circles due to license expiry. RCom is solely riding on 2 hopes: first it's consolidation with Sistema, which will add to it's 800/850 MHz spectrum holding and then sharing/trading this spectrum holding with RelJio and ride on the latter's 4G network. The slight chance of consolidating with RelJio is what is keeping RCom alive.

Future Possibilities:

The war for market share is going to be fought in the Data segment and 4G could be the technology of choice for most operators going forward. Airtel has already launched it's 4G service in over 300 cities/towns across it's 6 or 7 circles on 2300 MHz spectrum. Simultaneously, Airtel is acquiring the smaller 4G 2300 MHz spectrum holders. Rumours are also afloat that Airtel is in talks with Aircel to buy out it's 2300 MHz spectrum holding, which will give Airtel a 4G coverage across over 15 circles. Apart from 2300 MHz holdings, Airtel has 1800 MHz spectrum in many circles and hence Airtel could be the only other 4G player with a pan-India coverage, other than RelJio.

Idea & Vodafone are also rolling out 4G networks on their 1800 MHz spectrum holdings, wherever available. Idea also recently acquired Videocon's 1800 MHz spectrum in 2 circles, which were important to it. The pricing was much higher than the Auction-determined price, but that is the kind of urgency/panic amongst the incumbent operators to rollout 4G networks & try to protect their Revenues after RelJio's onslaught begins. Idea & Vodafone might need to hold hands together to offer a wider 4G presence across maximum circles as they are not self-sufficient, while Airtel is self-sufficient. Both Idea & Vodafone are on the verge of launching their own 4G service in few select cities. Both of them would look to scale up their networks to atleast a few hundred cities each in the circles where they hold good AGR share and wouldn't like to lose it in the coming months.

RCom's possible consolidation with Sistema is already announced. During the same announcement, it was mentioned that RCom will later get merged into Sistema's Global operations. In such a scenario, RCom might only look at spectrum sharing/trading with RelJio. I have a feeling that RelJio might not want to take over anything other than RCom's 800 MHz spectrum. In any case RCom's subscribers quality is not good & low revenue generators. There are reports which suggest that RelJio might look at keeping it's ARPU well over Rs.300/- by offering it's customers the complete package of Voice Calls, Data packs and even different kinds of Content. All this will unfold through the year 2016, starting in a couple of weeks from now. Going by RelJio's potential scale of network rollout, RelJio could be at No.4 or 5 position in AGR stakes in 12 months from now and will certainly be amongst the Top-3 before the end of year 2017.

It is still very unclear on how other operators like Aircel, Tata Tele & Telenor plan on surviving in the coming months/years. Telenor has played by a clear strategy of pure 2G service at ultra-low cost. It has done well by reaching operational break even in most of it's circles of operation. But the success of this strategy will depend on whether or not our Rural population upgrades to Data usage or not. I am sure that Telenor too would like & would have to enter the 4G fray sooner or later. Tata Tele & Aircel, both currently have decent sized operations, but have bigger worries on the Debt front. If they urgently don't get into consolidation mode with some other operator or bring in new larger investors, the chances of their survival are very bleak.

Over the next 12-24 months, I am expecting the following 4-5 players/groups to play an important role in the Indian Telecom space: Airtel & RelJio will certainly be there on their own individual merits; Vodafone & Idea will do better if they join forces via virtual JV or atleast Roaming agreements; BSNL&MTNL with their 3G/Broadband/WiFi services; Amongst the rest I am expecting Telenor to take a lead in some kind of consolidation exercise. I am saying so going by the seriousness with which Telenor has rapidly scaled up it's operations within those limited circles of operations and also achieved operational profitability in most of them. Let's see how things unfold.