Suzlon Energy Ltd. got rid of a substantial portion of it's Debt pain in the month of April'15 when it's sale transaction of it's German subsidiary Senvion, was executed. There was another big positive development for Suzlon in the first couple of months of 2015, which is the entry of a Strategic Investor in the form of Sun Pharma's promoter, in his personal capacity. Considering all these developments, I had written a post on Suzlon Energy Ltd. in the last week of February'2015. Here is the link to it:

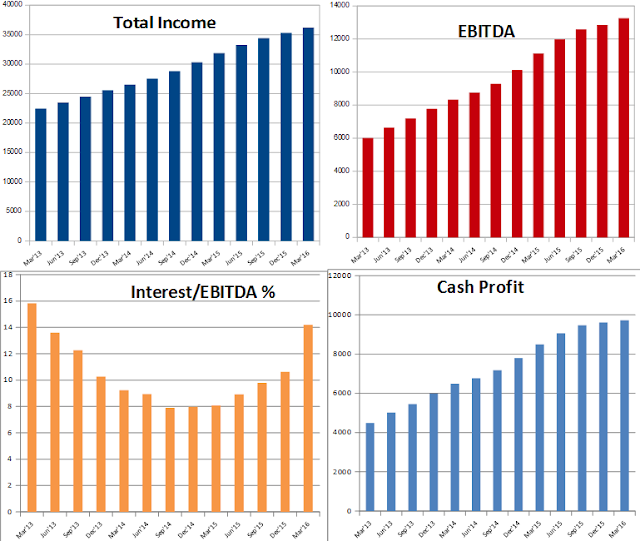

The chart alongside shows the T-T-M progress of Suzlon Energy's Interest Cost vs it's EBITDA. As was expected, Suzlon's 12-months Interest Cost has dropped rapidly and stood at little over Rs.1200 crores for March'16. I am pretty confident that the same will be around Rs.1000 crores within the next 1-2 quarters. At the same time, the company's EBITDA, which is currently falling a little short to cover the Interest Cost on 12-months basis, has already overtaken the latter during Q4-FY'16 on a quarterly basis. Even on 12-months basis, Suzlon's EBITDA is expected to be higher than it's Interest Cost either by end of June'16 or by Sept'16. This break-even at Cash Profit level gives a lot of confidence to all stakeholders of the company, including it's lenders.

Going forward, the growth the company is able to generate will depend on the Order Inflow momentum in the coming months & quarters. The order intake was extremely strong during Q4, which helped build Revenue-visibility for the company to about 9 to 10 months of current fiscal. But that is not enough. To enable the company to confidently expand it's capacity further, the Revenue-visibility should be in excess of 18 months. As per media release post announcement of Q4-FY'16 results, the management of Suzlon has mentioned that it is expecting the Wind Energy market in India to expand by another 30% in this fiscal and they are confident of doing better than industry growth. But I prefer to be conservative in my estimates and would be happy even if Suzlon manages a Topline growth of between 20 to 25% for FY'17 (i.e. Revenues of around Rs.11,500 to 12,000 crores), alongwith improvement in EBITDA margin to about 15% (i.e. an EBITDA of close to Rs.1800 crores). With Suzlon's Interest cost expected to dip further to little under Rs.1000 crores for FY'17, the company will be left with post-Interest Cash Profit of about Rs.800-850 crores.

Valuations: Suzlon's Equity Capital currently comprises of about 502 crore shares. But it's expected to increase further to over 550 crore shares once all the remaining FCCBs are converted into shares. At the current share price of around Rs.17/-, Suzlon's market capitalisation on fully-diluted equity capital stands at around Rs.9500 crores. At this level, the company is valued at just about 11-12 times it's Post-Interest Cash Profit expected for FY'17. This cannot be termed as very expensive valuations anymore, especially considering the positive momentum surrounding the company. But then if we have a look at the financial numbers & valuation of Suzlon's younger competitor, Inox Wind Ltd., which is also expected to manage a Post-Interest Cash Profit of around Rs.800-850 crores for FY'17, despite being much smaller in Revenue terms, purely because of sharply lower Interest burden. Inox Wind currently trades at a Market Cap of just about Rs.5300 crores, which is nearly 40% lower than Suzlon's current Market Cap. Suddenly Suzlon's valuation starts looking far expensive in comparison. Hence a lot will depend on whether & how Suzlon manages to outperform the conservative growth estimates I have mentioned above. If Suzlon does manage to post much stronger growth rates of around 40% or so, then we can say that it can hold on to the current valuations or even see some bit of up-rating. But I am not expecting any run-away rally in Suzlon stock in the coming few months. I would prefer to wait & watch the company's results for another 2 or 3 quarters before I can say if it deserves any higher Market Cap or not. Alternately, if the entire Industry is re-rated upwards, then Suzlon's stock could rally higher.

I am very happy to say that most of the expectations that I had expressed in that post have come perfectly true over the last 12-15 months. Suzlon's stock price was flying after the two big announcements & had more than doubled within a short span of time. I wanted Investors to have a realistic view of the things at Suzlon & not jump into it at crazy valuations.

Things have cooled down now and Suzlon's share price is about 40% lower than those levels about 15 months ago. Now lets to a reality check again based on the current situation.

Suzlon Energy Ltd's management has done an excellent job of reviving it's India operations in very quick time post sale of Senvion. The substantial Working Capital available to the company throughout last year certainly helped the management to get things moving rather quickly. The entry of a credible strategic investor also infused lots of confidence, not just in the management, but also amongst it's potential

customer base. As per my rough estimates, Suzlon Energy Ltd must have managed a near 60-70% growth in Revenues for it's Non-Senvion operations. The company posted a Total Income figure of about Rs.9600 crores for FY'16, which is closer to the upper limit of the expected range I had mentioned last year. On the EBITDA front, Suzlon managed to post little over Rs.1000 crores, which translates into an EBITDA margin of between 10 to 11%. What is even more heartening is that the EBITDA margin was consistently over 13% for the last 2 quarters of the fiscal gone by.The chart alongside shows the T-T-M progress of Suzlon Energy's Interest Cost vs it's EBITDA. As was expected, Suzlon's 12-months Interest Cost has dropped rapidly and stood at little over Rs.1200 crores for March'16. I am pretty confident that the same will be around Rs.1000 crores within the next 1-2 quarters. At the same time, the company's EBITDA, which is currently falling a little short to cover the Interest Cost on 12-months basis, has already overtaken the latter during Q4-FY'16 on a quarterly basis. Even on 12-months basis, Suzlon's EBITDA is expected to be higher than it's Interest Cost either by end of June'16 or by Sept'16. This break-even at Cash Profit level gives a lot of confidence to all stakeholders of the company, including it's lenders.

Going forward, the growth the company is able to generate will depend on the Order Inflow momentum in the coming months & quarters. The order intake was extremely strong during Q4, which helped build Revenue-visibility for the company to about 9 to 10 months of current fiscal. But that is not enough. To enable the company to confidently expand it's capacity further, the Revenue-visibility should be in excess of 18 months. As per media release post announcement of Q4-FY'16 results, the management of Suzlon has mentioned that it is expecting the Wind Energy market in India to expand by another 30% in this fiscal and they are confident of doing better than industry growth. But I prefer to be conservative in my estimates and would be happy even if Suzlon manages a Topline growth of between 20 to 25% for FY'17 (i.e. Revenues of around Rs.11,500 to 12,000 crores), alongwith improvement in EBITDA margin to about 15% (i.e. an EBITDA of close to Rs.1800 crores). With Suzlon's Interest cost expected to dip further to little under Rs.1000 crores for FY'17, the company will be left with post-Interest Cash Profit of about Rs.800-850 crores.

Valuations: Suzlon's Equity Capital currently comprises of about 502 crore shares. But it's expected to increase further to over 550 crore shares once all the remaining FCCBs are converted into shares. At the current share price of around Rs.17/-, Suzlon's market capitalisation on fully-diluted equity capital stands at around Rs.9500 crores. At this level, the company is valued at just about 11-12 times it's Post-Interest Cash Profit expected for FY'17. This cannot be termed as very expensive valuations anymore, especially considering the positive momentum surrounding the company. But then if we have a look at the financial numbers & valuation of Suzlon's younger competitor, Inox Wind Ltd., which is also expected to manage a Post-Interest Cash Profit of around Rs.800-850 crores for FY'17, despite being much smaller in Revenue terms, purely because of sharply lower Interest burden. Inox Wind currently trades at a Market Cap of just about Rs.5300 crores, which is nearly 40% lower than Suzlon's current Market Cap. Suddenly Suzlon's valuation starts looking far expensive in comparison. Hence a lot will depend on whether & how Suzlon manages to outperform the conservative growth estimates I have mentioned above. If Suzlon does manage to post much stronger growth rates of around 40% or so, then we can say that it can hold on to the current valuations or even see some bit of up-rating. But I am not expecting any run-away rally in Suzlon stock in the coming few months. I would prefer to wait & watch the company's results for another 2 or 3 quarters before I can say if it deserves any higher Market Cap or not. Alternately, if the entire Industry is re-rated upwards, then Suzlon's stock could rally higher.