What would you say when I tell you that there is a company which has managed to grow it's topline by over 85% in the last 2 years, it's EBITDA has grown by 130% and it's Net Profit has posted a growth of over 125% during the same period. This is not all. The superb growth record is just one part of the story. The best part is that, this company is still available at peanut valuations. It is currently trading at just about 3 times it's Trailing-Twelve-Months EPS and at less half of it's book value. But there is a catch: This company has a very small Equity Capital and most of it is being held by Long Term Investors (including Promoters). Hence there is very small trading volume in it's stock on the exchanges and one large order can suddenly create big movements in it's stock price. Hence it is a company purely for Long Term Investors, who can gradually accumulate it's shares over a period of time and then wait patiently for the market to give it it's due fair value.

The company that I am talking about here is Zicom Electronic Security Systems Ltd. The promoters of Zicom are 1st Generation Entrepreneurs, not coming from wealthy families. That is why they had to look for outside funding at a very early stage of the company's growth. During every subsequent Equity issuance since it's listing in 1996, the Promoter stake was getting diluted to some extent. That is the reason why the promoter holding in the company was very low at just 18.36% by 2010. Since then the Promoter group has tried to gradually increase it's stake. First they bought from the Open market & increased their stake to 20.76%. In the previous fiscal, Zicom raised fresh capital via preferential allotment of shares to the Promoter group and to one Singapore based PE Fund. The PE Fund took little over 17% in Zicom, while the Promoters managed to push their holding to 21.40%.

Coming back to Zicom's financial performance, it continues to post strong Y-o-Y double-digit growth. As of Sept'13, Zicom's T-T-M Total Income has reached the level of Rs.795 crores. Two years back it was at Rs.427 crores. During these 2 years, Zicom improved business mix of higher contribution from overseas ventures, has helped improve it's EBITDA margins from 10.13% to 12.53%. The near tripling of Interest Cost & more than Quadrupling of Tax outgo limited the improvement in Net Profit margin to just about 85 basis points to reach a figure of 4.62%.

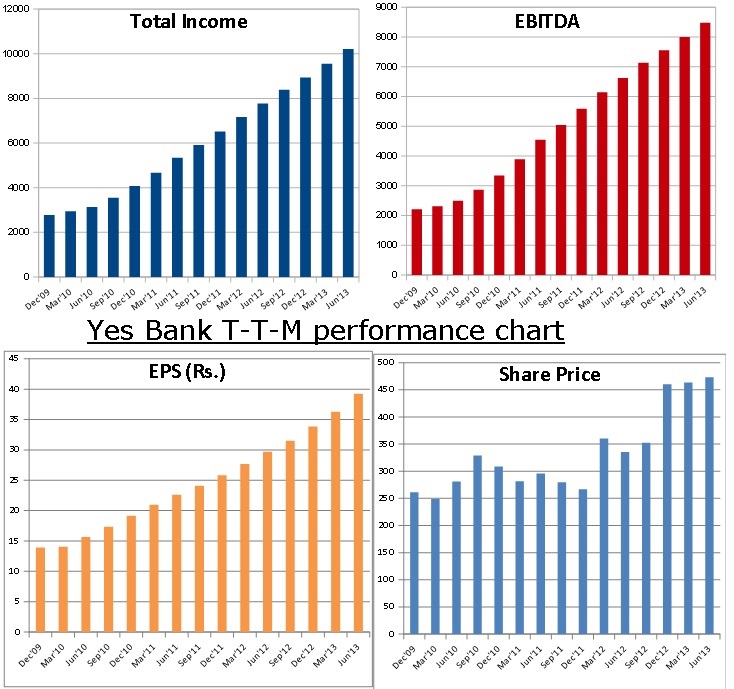

As you can see, Zicom's T-T-M Total Income & EBITDA have grown at an excellent pace over the last 8 quarters. The EPS did see a drop in between, but it was mainly because of expansion of Equity Capital of the company. After that, the EPS has grown at a faster pace. As of Sept'13, Zicom's 12-months EPS stands at Rs.21.50/-. That means at the current share price of about Rs.65/-, Zicom is valued at just about 3 times it's EPS. Isn't this the most attractive valuation one can find for such a wonderful performance track record??!! Zicom's book value stands at over Rs.150/-. It's share price will eventually get to it's fair value as it cannot remain highly undervalued permanently. The only condition being that Zicom should continue with a decent financial performance in the coming quarters as well.

From less than Rs.30 levels in December'2011, Zicom's share price went on to hit a high of Rs.100 level in December'2012. From there it corrected to about Rs.45 over the following nine months. And now it has started moving up again. This time I am expecting it to make a new high, much higher than the previous high of Rs.100/-. But please remember that in the meanwhile, the stock could test the investor's patience as nobody can predict the timeline precisely for a stock to achieve certain level. I will recommend gradual purchase of Zicom shares, few shares everyday, spread over several weeks. Any large order could create large movement in share price as the trading liquidity of this stock is very low. Just buy it in the price range of anything upto Rs.100/- and wait patiently. While waiting, please remember to monitor the company's business performance on a quarterly or half-yearly basis. If it continues to remain healthy, then you are sure earn multibagger returns on your investment in this company over the coming couple of years.

The company that I am talking about here is Zicom Electronic Security Systems Ltd. The promoters of Zicom are 1st Generation Entrepreneurs, not coming from wealthy families. That is why they had to look for outside funding at a very early stage of the company's growth. During every subsequent Equity issuance since it's listing in 1996, the Promoter stake was getting diluted to some extent. That is the reason why the promoter holding in the company was very low at just 18.36% by 2010. Since then the Promoter group has tried to gradually increase it's stake. First they bought from the Open market & increased their stake to 20.76%. In the previous fiscal, Zicom raised fresh capital via preferential allotment of shares to the Promoter group and to one Singapore based PE Fund. The PE Fund took little over 17% in Zicom, while the Promoters managed to push their holding to 21.40%.

Coming back to Zicom's financial performance, it continues to post strong Y-o-Y double-digit growth. As of Sept'13, Zicom's T-T-M Total Income has reached the level of Rs.795 crores. Two years back it was at Rs.427 crores. During these 2 years, Zicom improved business mix of higher contribution from overseas ventures, has helped improve it's EBITDA margins from 10.13% to 12.53%. The near tripling of Interest Cost & more than Quadrupling of Tax outgo limited the improvement in Net Profit margin to just about 85 basis points to reach a figure of 4.62%.

As you can see, Zicom's T-T-M Total Income & EBITDA have grown at an excellent pace over the last 8 quarters. The EPS did see a drop in between, but it was mainly because of expansion of Equity Capital of the company. After that, the EPS has grown at a faster pace. As of Sept'13, Zicom's 12-months EPS stands at Rs.21.50/-. That means at the current share price of about Rs.65/-, Zicom is valued at just about 3 times it's EPS. Isn't this the most attractive valuation one can find for such a wonderful performance track record??!! Zicom's book value stands at over Rs.150/-. It's share price will eventually get to it's fair value as it cannot remain highly undervalued permanently. The only condition being that Zicom should continue with a decent financial performance in the coming quarters as well.

From less than Rs.30 levels in December'2011, Zicom's share price went on to hit a high of Rs.100 level in December'2012. From there it corrected to about Rs.45 over the following nine months. And now it has started moving up again. This time I am expecting it to make a new high, much higher than the previous high of Rs.100/-. But please remember that in the meanwhile, the stock could test the investor's patience as nobody can predict the timeline precisely for a stock to achieve certain level. I will recommend gradual purchase of Zicom shares, few shares everyday, spread over several weeks. Any large order could create large movement in share price as the trading liquidity of this stock is very low. Just buy it in the price range of anything upto Rs.100/- and wait patiently. While waiting, please remember to monitor the company's business performance on a quarterly or half-yearly basis. If it continues to remain healthy, then you are sure earn multibagger returns on your investment in this company over the coming couple of years.

.png)

.png)