The options for investing in Telecom are quite limited in India. Only the No.1 (i.e. Bharti Airtel), No.3 (i.e. Idea Cellular) & No.4 (i.e. Reliance Communications) mobile operators in India are listed on Indian stock exchanges. Tata Teleservices (Mah.) Ltd., which is a small part of the No.7 operator TTSL, is also listed, but can be termed as a regional player due to it's 2-circle operations. Another option that can be ignored is MTNL, which is again a 2-metro circles operation only and can be termed as completely lacklustre due to it's past performance.

Other players like Vodafone, Uninor, Aircel, BSNL, etc. are unlisted entities. Amongst the listed options, it is only the Top-2, i.e. Bharti Airtel & Idea Cellular, which are reporting strong growth in their India operations and also commanding strong market shares and consistant profitability. Bharti Airtel has operations in about 20 countries, which includes India and few other South-Asian countries and also in many countries of Africa. Bharti Airtel is also not just a pure-play mobile services provider, but it offers a gamut of services like DTH, Wireline, International Bandwidth, etc. The contribution from India-based business is nearly 60-65% in Bharti Airtel's Topline. On the other hand Idea Cellular is a pure-play mobile services provider based only in India.

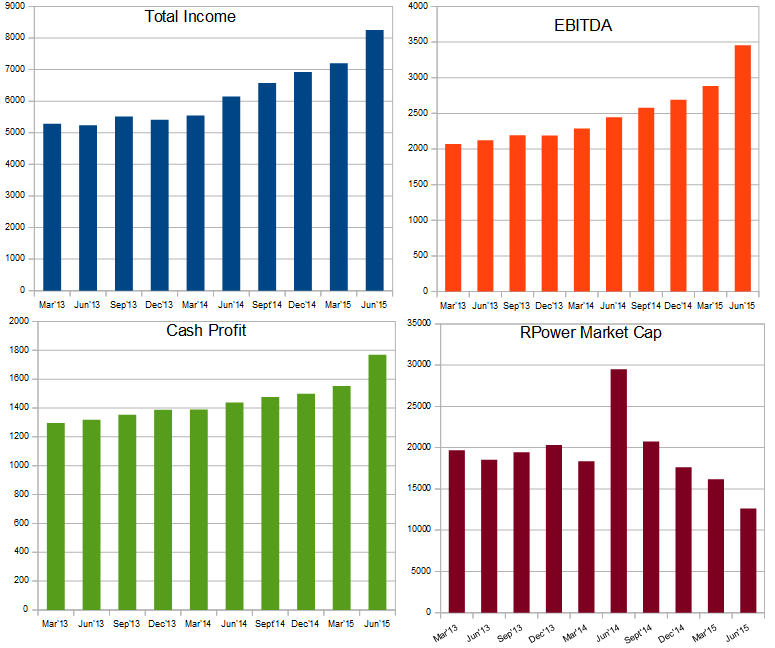

In terms of size, Bharti Airtel is nearly 3 times the size of Idea Cellular, when Toplines are considered. To compare their performances over the recent 3 years, what I did was to compare how much percentage was Idea Cellular's Consolidated T-T-M numbers compared to Bharti Airtel's Consolidated T-T-M numbers. If the 2 companies grew at the same pace, then the percentage number will remain stagnant, but if Idea Cellular has grown faster, then the percentage number will rise & vice-versa. Have a look at the charts below. I have compared T-T-M numbers from June'2012 to June'2015 to give us a reasonable idea of who outperformed over the last 3 years.

From the charts above, it is extremely obvious that Idea Cellular has been the clear outperformer on Total Income, EBITDA and Cash Profit front. In the case of Total Income, Idea Cellular's number was just about 28% of Bharti Airtel's number at the end of June'12, which remained around the same level till March'13. But over the next 9 quarters, that percentage has shot up to touch a figure of 35.8% by June'15. There are two primary reasons for this huge outperformance by Idea Cellular: One being Idea's faster growth by some margin in the Indian Telecom market; and Second being very slow or negligible growth in Bharti Airtel's Africa business, which contributes over 25% to the company's Total Income.

On the EBITDA and Cash Profit front, the outperformance by Idea Cellular is even more staggering!! At the end of June'12, Idea's EBITDA formed just 22.3% of Airtel's EBITDA. But the number has shot up to 37.6% by June'15, i.e. over the last 12 quarters. In case of Cash Profits, the percentage number has nearly doubled from a level of 21.9% in June'12 to 42.8% in June'15. This is just too big an outperformance to ignore. Now look at the progress of T-T-M Cash Profit margins for the two companies. Bharti Airtel's Cash Profit margin dropped from 24.1% in June'12 to a figure of 21.5% in June'14, but has started improving after that to touch a figure of 22.8% in June'15. In case of Idea Cellular, the change has been consistently positive from a level of 19% in June'12 to a very very respectable figure of 27.3% in June'15.

Valuations: At the current price of Rs.157 per share, Idea Cellular commands a Market Cap of Rs.56,500 crores, which is 6.2 times it's T-T-M Cash Profit. In case of Bharti Airtel, the Market Cap stands at about Rs.1,52,000 crores at the current price of Rs.380 per share. At this price, it trades at about 7.2 times it's T-T-M Cash Profit. What this means is that despite strong outperformance on all Financial parameters over the last 3 years, Idea Cellular still trades at about 15% cheaper valuations compared to it's larger peer Bharti Airtel.

Could this mean that the market expects Bharti Airtel to better face the upcoming competition compared to Idea Cellular? If we look at the spectrum holdings in Indian space, Bharti Airtel is clearly the better bet as it holds considerable amount in all crucial frequencies like 900 MHz, 1800 MHz, 2100 MHz and 2300 MHz in various circles. After the recent auctions, Bharti Airtel is now said to be able to offer 3G services on either 2100 MHz or 900 MHz spectrum in 21 of the 23 circles in the country and hence will be less dependent on Roaming arrangements. Bharti Airtel can use it's 2300 MHz and 1800 MHz band holdings for 4G services, but it doesn't have these holdings in all the circles at the moment. On the other hand, what Idea Cellular has done is to ensure that it has enough spectrum holdings in all it's prime circles where it is No.1 or 2 operator and is able to combat any competition as these circles contribute nearly 65-70% of it's Revenues and almost all it's profits. Idea Cellular has a combination of holdings in the 900 MHz, 1800 MHz and 2100 MHz bands in most of the circles of operations. Idea Cellular will use a combination of 3G and 4G technologies using these bands to protect it's revenues from upcoming competition. 4G on 1800 MHz band in certain circles and 3G on 900 MHz and 2100 MHz bands in most of the other circles.

The developments are going to be fast & very very interesting to watch in the coming few quarters. The upcoming competition from RelJio is not very far and the existing operators will have to move swiftly to try & protect their revenues. The Data services market has been exploding over the last few years and the growth is expected to remain strong over the next few years. Every operator is trying to arm themselves with capacities to take a good chunk of this growth. I am not going to hazard a guess as to who will do better in protecting their revenues from the new competition next year onwards or whether the new competition will actually make a huge dent in the market shares or not. I would like to wait for more things to unfold & then take a calculated guess.

Other players like Vodafone, Uninor, Aircel, BSNL, etc. are unlisted entities. Amongst the listed options, it is only the Top-2, i.e. Bharti Airtel & Idea Cellular, which are reporting strong growth in their India operations and also commanding strong market shares and consistant profitability. Bharti Airtel has operations in about 20 countries, which includes India and few other South-Asian countries and also in many countries of Africa. Bharti Airtel is also not just a pure-play mobile services provider, but it offers a gamut of services like DTH, Wireline, International Bandwidth, etc. The contribution from India-based business is nearly 60-65% in Bharti Airtel's Topline. On the other hand Idea Cellular is a pure-play mobile services provider based only in India.

In terms of size, Bharti Airtel is nearly 3 times the size of Idea Cellular, when Toplines are considered. To compare their performances over the recent 3 years, what I did was to compare how much percentage was Idea Cellular's Consolidated T-T-M numbers compared to Bharti Airtel's Consolidated T-T-M numbers. If the 2 companies grew at the same pace, then the percentage number will remain stagnant, but if Idea Cellular has grown faster, then the percentage number will rise & vice-versa. Have a look at the charts below. I have compared T-T-M numbers from June'2012 to June'2015 to give us a reasonable idea of who outperformed over the last 3 years.

From the charts above, it is extremely obvious that Idea Cellular has been the clear outperformer on Total Income, EBITDA and Cash Profit front. In the case of Total Income, Idea Cellular's number was just about 28% of Bharti Airtel's number at the end of June'12, which remained around the same level till March'13. But over the next 9 quarters, that percentage has shot up to touch a figure of 35.8% by June'15. There are two primary reasons for this huge outperformance by Idea Cellular: One being Idea's faster growth by some margin in the Indian Telecom market; and Second being very slow or negligible growth in Bharti Airtel's Africa business, which contributes over 25% to the company's Total Income.

On the EBITDA and Cash Profit front, the outperformance by Idea Cellular is even more staggering!! At the end of June'12, Idea's EBITDA formed just 22.3% of Airtel's EBITDA. But the number has shot up to 37.6% by June'15, i.e. over the last 12 quarters. In case of Cash Profits, the percentage number has nearly doubled from a level of 21.9% in June'12 to 42.8% in June'15. This is just too big an outperformance to ignore. Now look at the progress of T-T-M Cash Profit margins for the two companies. Bharti Airtel's Cash Profit margin dropped from 24.1% in June'12 to a figure of 21.5% in June'14, but has started improving after that to touch a figure of 22.8% in June'15. In case of Idea Cellular, the change has been consistently positive from a level of 19% in June'12 to a very very respectable figure of 27.3% in June'15.

Valuations: At the current price of Rs.157 per share, Idea Cellular commands a Market Cap of Rs.56,500 crores, which is 6.2 times it's T-T-M Cash Profit. In case of Bharti Airtel, the Market Cap stands at about Rs.1,52,000 crores at the current price of Rs.380 per share. At this price, it trades at about 7.2 times it's T-T-M Cash Profit. What this means is that despite strong outperformance on all Financial parameters over the last 3 years, Idea Cellular still trades at about 15% cheaper valuations compared to it's larger peer Bharti Airtel.

Could this mean that the market expects Bharti Airtel to better face the upcoming competition compared to Idea Cellular? If we look at the spectrum holdings in Indian space, Bharti Airtel is clearly the better bet as it holds considerable amount in all crucial frequencies like 900 MHz, 1800 MHz, 2100 MHz and 2300 MHz in various circles. After the recent auctions, Bharti Airtel is now said to be able to offer 3G services on either 2100 MHz or 900 MHz spectrum in 21 of the 23 circles in the country and hence will be less dependent on Roaming arrangements. Bharti Airtel can use it's 2300 MHz and 1800 MHz band holdings for 4G services, but it doesn't have these holdings in all the circles at the moment. On the other hand, what Idea Cellular has done is to ensure that it has enough spectrum holdings in all it's prime circles where it is No.1 or 2 operator and is able to combat any competition as these circles contribute nearly 65-70% of it's Revenues and almost all it's profits. Idea Cellular has a combination of holdings in the 900 MHz, 1800 MHz and 2100 MHz bands in most of the circles of operations. Idea Cellular will use a combination of 3G and 4G technologies using these bands to protect it's revenues from upcoming competition. 4G on 1800 MHz band in certain circles and 3G on 900 MHz and 2100 MHz bands in most of the other circles.

The developments are going to be fast & very very interesting to watch in the coming few quarters. The upcoming competition from RelJio is not very far and the existing operators will have to move swiftly to try & protect their revenues. The Data services market has been exploding over the last few years and the growth is expected to remain strong over the next few years. Every operator is trying to arm themselves with capacities to take a good chunk of this growth. I am not going to hazard a guess as to who will do better in protecting their revenues from the new competition next year onwards or whether the new competition will actually make a huge dent in the market shares or not. I would like to wait for more things to unfold & then take a calculated guess.