Until Q4 of FY'15, Reliance Power's Quarterly Total Income had stabilised around the Rs.1800 crores mark & Cash Profit was around the Rs.375 to 390 crores range. In my previous report on Reliance Power I had mentioned my expectations from the company's first UMPP at Sasan. I was expecting an addition of about Rs.800-850 crores to the Quarterly Revenues and an addition of Rs.100 crores to the Quarterly Cash Profit, on the conservative side. The Interest burden was expected to consume most of the revenues from this project.

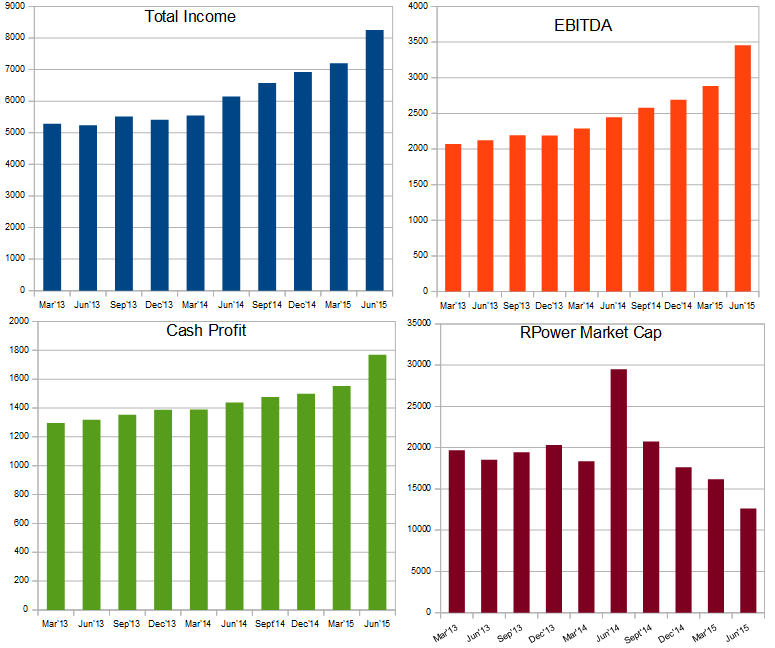

But the Q1-FY'16 result clearly proved that my estimates were quite conservative truly. RPower's Total Income jump was around Rs.1000 crores, while Cash Profit jumped by around Rs.200 crores. Infact the project even contributed to the company's Net Profit right in the first quarter of consolidation!! This performance is much better than expected. In absolute sense, RPower's Total Income was higher by 58% Y-o-Y, EBITDA was higher by 82%, Cash Profit was higher by 58% and Net Profit was higher by 41%. We can expect similar kind of number for the remaining 3 quarter of this year.

But the Q1-FY'16 result clearly proved that my estimates were quite conservative truly. RPower's Total Income jump was around Rs.1000 crores, while Cash Profit jumped by around Rs.200 crores. Infact the project even contributed to the company's Net Profit right in the first quarter of consolidation!! This performance is much better than expected. In absolute sense, RPower's Total Income was higher by 58% Y-o-Y, EBITDA was higher by 82%, Cash Profit was higher by 58% and Net Profit was higher by 41%. We can expect similar kind of number for the remaining 3 quarter of this year.

|

Trailing-Twelve-Months Numbers |

We can expect RPower's T-T-M Total Income to progress from a little over Rs.8200 crores currently to closer to about Rs.12000 crores by the end of this fiscal. RPower's T-T-M EBITDA, which currently stands at little under Rs.3500 crores, will progress to a little over Rs.5000 crores over the next 3 quarters and the Cash Profit will go past the Rs.2300 crores mark. Now look at the Market Cap chart above. RPower's Market Cap has continuously fallen from levels close to Rs.30,000 crores at the end of June'14 to under Rs.12,000 crores today (at a price of under Rs.42/- per share today.). This is completely senseless, isn't it? RPower's annual Cash Profit is expected to improve to over Rs.2300 crores in the next three quarters and the company is valued at just about 5 times of that number!! This is irrationally low valuation and reflects the fear that investors have in their minds about Power companies in general and the disappointment & anger associated with RPower during it's IPO time. But it is excellent opportunity for those investors who can ignore the above two factors.

Reliance Power is one company in the power sector which is have good operational projects with no issues related to fuel availability to these operating projects. No issues related to repayment of debt even at the consolidated level. All it's projects are working at very healthy PLF levels of over 80% comfortably, quarter after quarter. RPower clearly has healthy Cash Position, unlike most other Private sector power producers who are struggling even to cover their operating costs & interest payments. Despite all these positives, RPower is trading at such pathetic valuations. Just doesn't make any sense.

I think RPower deserves to double from current levels over the next 3-4 quarters to get to a Market Cap of 10 times it's annual Cash Profits, if not more. At a price of about Rs.80-85 per share, RPower will still be trading at about 18 times it's T-T-M expected EPS of about Rs.4.50 to 5/-.

Another positive is that RPower is not going aggressively after increasing it's Thermal Power capacities. I think this is positive because there are many thermal power projects which are currently struggling. Instead RPower is increasing it's Renewable Power capacities, mainly Solar. RPower has 45 MW Solar PV capacity operational in Rajasthan since the last year or so, and another 45 MW Wind Power capacity operational in Maharashtra. Both these projects together are generating about 3.5 crore units of electricity every quarter, translating into revenues of around Rs.200 crores & with negligible operating costs. During the June'15 quarter, another 100 MW Concentrated Solar Plant in Rajasthan has started generating electricity and will add to the company's revenues and cash profits from Sept.'15 quarter. At the same time RPower is working on commissioning another 700 MW Solar PV capacity, which could get operational sometime during the next 12-18 months.

During the recent Bangladesh visit of our PM, there was news about Adani Power & Reliance Power investing in setting up Thermal power capacities in that country. In case of Reliance Power, that project is not going to entail Huge Capex as the company already has Project Equipment ready & unused at one of it's proposed project site in Andhra Pradesh, which never took off due to lack of Gas availability. Reliance Power has announced that it will be using the same equipment for the Bangladesh project. I am not giving too much importance to this project currently because it is atleast 3 years away from commissioning.

As of now we should focus on the current operating capacities and the upcoming Solar capacities only.

No comments:

Post a Comment