Amongst the Top-2 listed Telecom stocks, i.e. Bharti Airtel & Idea Cellular, the comparison of their respective stock price movements over the last 12-15 months is quite interesting. Bharti Airtel's stock did hit a high of around Rs.450 sometime in the month of July'15. It is currently trading at a little under Rs.360, which is a 20-21% erosion from those peaks.

On the other hand Idea Cellular's stock had hit a high of just over Rs.200 sometime in the month of April'15. It is currently trading at just over Rs.100, which is a 50% erosion from those levels. All this despite the fact that Idea Cellular has posted superior growth than any of it's large or small peers over the last few years.

Then why has Idea Cellular's stock price massively under-performed that of Bharti Airtel over the last 1 year or so? Is the market suggesting that Idea Cellular is going to face much more worse times in the coming quarters, as compared to Bharti Airtel, possibly due to upcoming competition from Reliance Jio's 4G launch. Even I have been saying in my recent posts on Telecom stocks/industry that Bharti Airtel is better placed than any other existing operator to face the upcoming competition. But certain developments in the recent weeks made me think that one needs to see how Idea Cellular is preparing itself for the upcoming competition.

I am a resident of a small coastal town in Maharashtra. In this telecom circle of Rest of Maharashtra & Goa, Idea Cellular is the undisputed No.1 player with about 33% revenue market share, followed by Vodafone with about 24% and Bharti Airtel at No.3 with just under 13% market share. In the first round of 3G spectrum auctions over half a decade ago, Idea Cellular & Vodafone, amongst the Top-3, grabbed 3G licences for this circle. Idea Cellular was the most aggressive in rolling out it's 3G network and I got to experience 3G in my little town sometime in late 2013. Vodafone's 3G arrived over 6 months later and Airtel had a ICR agreement with Vodafone so that Airtel's subscribers could enjoy 3G on Vodafone's network. Airtel acquired it's own 3G spectrum for RoM&G circle last year and now even my town has Airtel's 3G network since the last few months. Despite strong competition in 3G space, Idea Cellular has not just managed to maintain it's lead in this circle, it has even managed to improve it's market share over the recent years.

Coming to 4G situation, Airtel has been holding the 2300 MHz BWA spectrum for Rest of Maharashtra & Goa circle since the last 6 years, but did not lay the 4G network beyond a few important cities until last year. Airtel got aggressive on 4G rollout only in the middle of last year, when Reliance indicated the mammoth size of it's network rollout. It's been almost a year since Airtel started rolling out 4G network in more & more cities/towns at an aggressive pace, but it still hasn't reached my little town. We have had Jio's 4G signal for the last year or more. On the other hand I was pleasantly surprised to see Idea's 4G signal being detected in my town since the last few days. Then I had a look at Idea Cellular's website for 4G coverage information. Even though it has 4G capable spectrum in only about 10 circles and it started rolling out it's 4G network only about 6-7 months ago, Idea Cellular has certainly been way more aggressive in expanding it's 4G coverage than Bharti Airtel. Considering the super aggression in it's 4G network rollout, I think Idea Cellular is doing it's best to protect it's market position as much as possible, especially in the circles where it already is the strongest player in terms of market share.

Another point to consider is Idea's ability to offer 3G or 4G or both services in the circles that matter the most to the company. Idea is capable of offering both 3G & 4G service in 7 circles (including the important ones like Maharashtra, Kerala, MP, AP), which together contribute about 59-60% of the company's Revenues and a much higher proportion of it's profits. Then there are another 6 circles (including Delhi, Gujarat, both UP circles & Kolkata) where Idea Cellular is offering only 3G service and these circles together contribute about 23-24% of it's Revenues. Then there are another 4 circles (including Tamil Nadu & Karnataka) where Idea Cellular will be offering only 4G service. These 4 circles currently contribute just about 6% of it's revenues, but have the potential to grow strongly with the introduction of 4G. That means Idea Cellular has the ability to offer either 3G or 4G or both services in 17 circles, which together contribute almost 89% of it's AGR. All this supported by it's well entrenched 2G network, which is spread across all 22 circles. Ultimately 2G network will be used purely for Voice calls as it is lot more efficient for the operators to carry Data on 3G or 4G networks.

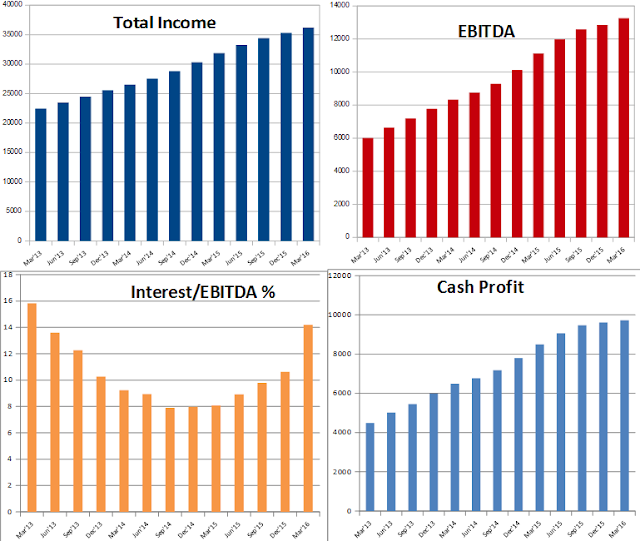

Coming to Financials, have a look at the Trailing-Twelve-Month charts alongside. The strong growth in Total Income & EBITDA will vanish once Reliance Jio comes in. But I am not expecting it to go really bad for Idea Cellular. Over the initial 4 quarters of Jio's launch I am expecting Idea's Total Income to drop by about 5-10% at the most and EBITDA to drop by about 20%. Idea's EBITDA could still remain above Rs.10,000 crores mark. The company's T-T-M Interest Cost, which currently stands at about Rs.1882 crores, is expected to peak out at about Rs.2800 to 3000 crores over the next few quarters. This will still leave Idea Cellular with a comfortable Cash Profit of around Rs.7000 crores. All this estimates are mainly because of the initial hit that all existing operators are expected to take due to Reliance Jio's launch. But things will stabilise after a few quarters and I am expecting the numbers to start improving again for Idea Cellular. A part of the reason for this expected improvement is that by then some of the smaller operators could be looking to exit, leaving the market for the larger players.

At the current share price of about Rs.100, the market cap of Idea Cellular stands at just about Rs.36,000 crores, which is less than 4 times it's current T-T-M Cash Profit. I have a feeling that the market has under estimated Idea Cellular's ability to compete in the face of increased competition. Yes, Idea Cellular's financials will get worse initially once Reliance Jio is in the ring, but things will start improving again after the initial impact. We cannot ignore the fact the Idea Cellular has very strong brand recall across the country. Idea is the No.1 operator in 4 important circles and No.2 in another 6 circles. Idea does have a strong connect with Rural India and any improvement in Rural lifestyle will directly benefit the company. Also a lot depends on how aggressively Reliance Jio prices it's 4G services and what kind of customers it targets and how the market accepts it's services. Hopefully we will have a better idea of it by the end of this calendar year.

|

| (Image from Moneycontrol.com) |

Then why has Idea Cellular's stock price massively under-performed that of Bharti Airtel over the last 1 year or so? Is the market suggesting that Idea Cellular is going to face much more worse times in the coming quarters, as compared to Bharti Airtel, possibly due to upcoming competition from Reliance Jio's 4G launch. Even I have been saying in my recent posts on Telecom stocks/industry that Bharti Airtel is better placed than any other existing operator to face the upcoming competition. But certain developments in the recent weeks made me think that one needs to see how Idea Cellular is preparing itself for the upcoming competition.

I am a resident of a small coastal town in Maharashtra. In this telecom circle of Rest of Maharashtra & Goa, Idea Cellular is the undisputed No.1 player with about 33% revenue market share, followed by Vodafone with about 24% and Bharti Airtel at No.3 with just under 13% market share. In the first round of 3G spectrum auctions over half a decade ago, Idea Cellular & Vodafone, amongst the Top-3, grabbed 3G licences for this circle. Idea Cellular was the most aggressive in rolling out it's 3G network and I got to experience 3G in my little town sometime in late 2013. Vodafone's 3G arrived over 6 months later and Airtel had a ICR agreement with Vodafone so that Airtel's subscribers could enjoy 3G on Vodafone's network. Airtel acquired it's own 3G spectrum for RoM&G circle last year and now even my town has Airtel's 3G network since the last few months. Despite strong competition in 3G space, Idea Cellular has not just managed to maintain it's lead in this circle, it has even managed to improve it's market share over the recent years.

Coming to 4G situation, Airtel has been holding the 2300 MHz BWA spectrum for Rest of Maharashtra & Goa circle since the last 6 years, but did not lay the 4G network beyond a few important cities until last year. Airtel got aggressive on 4G rollout only in the middle of last year, when Reliance indicated the mammoth size of it's network rollout. It's been almost a year since Airtel started rolling out 4G network in more & more cities/towns at an aggressive pace, but it still hasn't reached my little town. We have had Jio's 4G signal for the last year or more. On the other hand I was pleasantly surprised to see Idea's 4G signal being detected in my town since the last few days. Then I had a look at Idea Cellular's website for 4G coverage information. Even though it has 4G capable spectrum in only about 10 circles and it started rolling out it's 4G network only about 6-7 months ago, Idea Cellular has certainly been way more aggressive in expanding it's 4G coverage than Bharti Airtel. Considering the super aggression in it's 4G network rollout, I think Idea Cellular is doing it's best to protect it's market position as much as possible, especially in the circles where it already is the strongest player in terms of market share.

Another point to consider is Idea's ability to offer 3G or 4G or both services in the circles that matter the most to the company. Idea is capable of offering both 3G & 4G service in 7 circles (including the important ones like Maharashtra, Kerala, MP, AP), which together contribute about 59-60% of the company's Revenues and a much higher proportion of it's profits. Then there are another 6 circles (including Delhi, Gujarat, both UP circles & Kolkata) where Idea Cellular is offering only 3G service and these circles together contribute about 23-24% of it's Revenues. Then there are another 4 circles (including Tamil Nadu & Karnataka) where Idea Cellular will be offering only 4G service. These 4 circles currently contribute just about 6% of it's revenues, but have the potential to grow strongly with the introduction of 4G. That means Idea Cellular has the ability to offer either 3G or 4G or both services in 17 circles, which together contribute almost 89% of it's AGR. All this supported by it's well entrenched 2G network, which is spread across all 22 circles. Ultimately 2G network will be used purely for Voice calls as it is lot more efficient for the operators to carry Data on 3G or 4G networks.

Coming to Financials, have a look at the Trailing-Twelve-Month charts alongside. The strong growth in Total Income & EBITDA will vanish once Reliance Jio comes in. But I am not expecting it to go really bad for Idea Cellular. Over the initial 4 quarters of Jio's launch I am expecting Idea's Total Income to drop by about 5-10% at the most and EBITDA to drop by about 20%. Idea's EBITDA could still remain above Rs.10,000 crores mark. The company's T-T-M Interest Cost, which currently stands at about Rs.1882 crores, is expected to peak out at about Rs.2800 to 3000 crores over the next few quarters. This will still leave Idea Cellular with a comfortable Cash Profit of around Rs.7000 crores. All this estimates are mainly because of the initial hit that all existing operators are expected to take due to Reliance Jio's launch. But things will stabilise after a few quarters and I am expecting the numbers to start improving again for Idea Cellular. A part of the reason for this expected improvement is that by then some of the smaller operators could be looking to exit, leaving the market for the larger players.

At the current share price of about Rs.100, the market cap of Idea Cellular stands at just about Rs.36,000 crores, which is less than 4 times it's current T-T-M Cash Profit. I have a feeling that the market has under estimated Idea Cellular's ability to compete in the face of increased competition. Yes, Idea Cellular's financials will get worse initially once Reliance Jio is in the ring, but things will start improving again after the initial impact. We cannot ignore the fact the Idea Cellular has very strong brand recall across the country. Idea is the No.1 operator in 4 important circles and No.2 in another 6 circles. Idea does have a strong connect with Rural India and any improvement in Rural lifestyle will directly benefit the company. Also a lot depends on how aggressively Reliance Jio prices it's 4G services and what kind of customers it targets and how the market accepts it's services. Hopefully we will have a better idea of it by the end of this calendar year.

No comments:

Post a Comment