Yes Bank has been following perfectly on HDFC Bank's foot-steps. The only major difference between the two modern Private Sectors Banks being the gap in the time of inception. Because of that gap, HDFC Bank is nearly four times the size of Yes Bank in almost all aspects. But there are many similarities between Yes Bank & HDFC Bank, like: High quality experienced management, focus on corporate business, quality of loan book is not compromised to gain volume market-share. This strategy of focusing on high-quality assets has helped HDFC Bank gain tremendous respect from global investors over the last decade & more. That is the reason why HDFC Bank's stock trades at premium valuations compared to all other public as well as private sectors banks. Since Yes Bank too is walking on the same lines, it's valuations too will rise above the rest in the coming years.

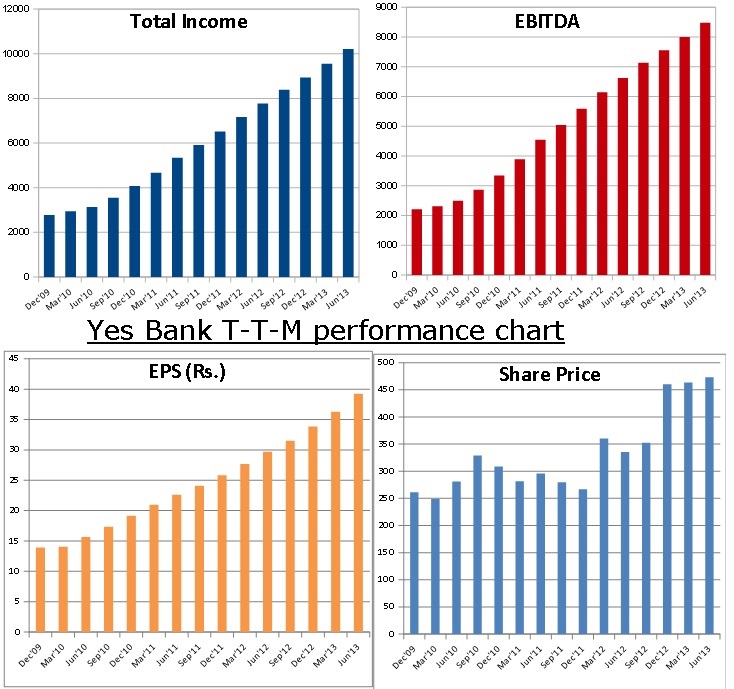

About two years ago, Yes Bank's stock was commanding P/E ratio of around 17 to 18, while the bank was consistantly posting a growth rate of over 50% Y-o-Y. Over the last two years, Yes Bank's growth has moderated to between 30 to 35% range, mainly because of the high-base effect. The market has responded by lowering Yes Bank stocks' P/E ratio to between 11 to 14 range. Yes Bank has now crossed the Rs.10,000 crores Total Income mark on a T-T-M basis, while it's Net Profit is over Rs.1400 crores, translating into an T-T-M EPS of Rs.39/-. If the current momentum continues, Yes Bank could be reporting an EPS of around Rs.46/- for FY'14. But RBI's recent moves to control money-market liquidity is expected to impact Cost of Funds for all those banks more who don't have a very good CASA (Current Account Savings Account) ratio. Since Yes Bank falls in that category, the market is expecting Yes Bank's growth & profitability to suffer more than most other banks.

But I think the market is ignoring two important aspects: (1) RBI's moves to control liquidity are temporary & may not last for more than a month or two; (2) Yes Bank management's ability to cope with this situation. I think Yes Bank's management has all the experience required to adjust to tight-liquidity situations. They will push for higher growth in their CASA deposits in the coming months. During Q1 of FY'14, Yes Bank has reported a growth of about 86% in their CASA deposits. This growth momentum could continue in the coming months & quarters as well. It will partially fulfill the bank's hunger for capital needed to expand it's loan book. And if it feels necessary, Yes Bank could raise fresh capital via preferential issue of shares as well.

Overall, I think the market has over-reacted to RBI's steps by thrashing Yes Bank's stock to under Rs.400 levels. At the current price of about Rs.375/-, it is trading at less than 10 times it's T-T-M EPS. I think, even if the Bank's profit growth slows down for a few months, it will get back to the 30% mark later. Hence this is an opportunity to invest in the growth of a high-quality Private Sector Bank at valuations of a common Public Sector Bank. Invest with a medium to long term view of 1 year to 5 years duration. This stock will definitely deliver handsome double-digit returns to it's investors from the current levels.